Home A Loan Blogs

e-KYC Revoked? Here Is How Can You Still Empower Your Customers To Do e-KYC.

Keep your e-KYC running without any hindrance. WhatsLoan is here!

Home A Loan Blogs

e-KYC Revoked? Here Is How Can You Still Empower Your Customers To Do e-KYC.

Keep your e-KYC running without any hindrance. WhatsLoan is here!

Aadhar based e-KYC limitations have caused trouble to FinTech startups.

e-KYC enables an Indian citizen having an Aadhaar number to share their demographic information and photograph with a UIDAI partner organization in an online, secure, auditable manner with the user’s consent. The consent can be given by a biometric authentication or an OTP (One Time Password).

FinTech companies such as e-wallets, online lenders, and NBFCs use e-KYC to electronically verify the authenticity of their customers’ identity.

Typically most of the FinTech companies are not AUAs ( Aadhaar Authentication User Agency), or KUAs (KYC User Agency), but they are sub-KUAs, and sub-AUAs. This means they send their requests through UIDAI network licenses to do the online validations avoiding the physical need to collect and to verify Aadhaar Identity Card.

RBI, NHB, SEBI, IRDA, TRAI have made this mandatory for all banks, lenders, NBFC, HFC, payment wallets , BFSI and Telecom companies to do complete KYC for a customer in order to enable the individual to use the services.

The KYC (Know Your Customer) is paper-based, physical process, and has high costs and time delays.

Cost For A FinTech Company/ Lender for Physical and E-Verification of KYCs

Physical KYC = High Agency Costs + Operational Costs + 1 Day TAT

e-KYC = Lowest Validation Fee + No Operational Cost + less than a minute TAT

This reflects the cost escalation (money+time) to any fintech or lending company if they have to follow the physical KYC instead of e-KYC. Also, this will defeat the purpose of digital companies of reaching the unreachable geographies and serving the unserved, and the speed of onboarding a customer for financial service.

A couple of weeks ago UIDAI has revoked the access as it has made critical observations around multiple unregulated entities accessing the database such as FinTech companies, e-commerce companies, and web-based businesses.

This will result in an increase in cost for the companies and longer turn around time as this will need physical verification of the customer KYCs.

Since UIDAI has revoked access to several agencies that provide e-KYC verification and authentication services to FinTech companies, the FinTech companies have filed a petition with UIDAI to re-store e-KYC verification.

Until the UIDAI takes the plea into consideration and provides some relaxation, the FinTech companies can still provide e-KYC to their customers using WhatsLoan Platform.

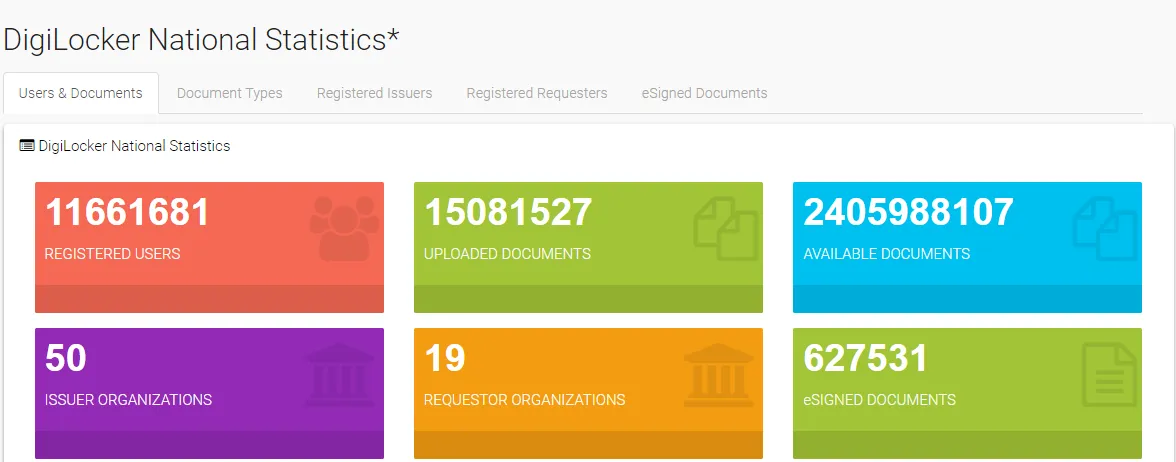

WhatsLoan is one among the 19 authorized requestors of DigiLocker (Govt of India’s cloud platform for storage, sharing, and verification of documents & certificates). DigiLocker has 210 different types of digital documents. A requester can verify the documents issued by the government agencies and uploaded by an individual on the DigiLocker cloud which is shared through requestor, securely, with a digital signature with time stamping of the document. This is used by WhatsLoan to continue the individual’s Aadhar validation without any hindrance in spite of AUAs and KUAs stopping the services.

If your company or your assigned agency is unable to request the e-KYC, WhatsLoan can provide you the DigiLocker access which is permitted even after UIDAI has shut down the access to most of the FinTech companies and other BFSI entities.

WhatsLoan is a Loan as a Service Platform (LASS) connecting the loan need of the borrower to the right lender. We believe that “For every borrower, there is a lender”. Unlike other lending platforms, we don’t sell the loan products, but we buy the borrower’s loan needs. Our vision is to ensure that every borrower is loan ready for any type of loan from any lender and anytime with our unique financial identity (a Digital Loan Key for self validation by a borrower on the web or mobile or assisted validation by a lending company).

WhatsLoan offers all digital, paperless at customer level instance, in minutes (1–2 minutes) secure, 100% full proof verification of documents from Indiastack, Digilocker and various other Govt. provided APIs through our LaaS-Loan as a Service Stack.

We also offer, passing KYC Data, Financial, Bank, Bureau Data through our system (other than Aadhar as of now) by batch process for large numbers and individually for customer-facing channels, branch, web, mobile , agents etc just by picking up document number such as Driving License Number, Voter ID Number, NAREGA Number , E-Bills Number, Telephone Number , Gas Number with couple of data points as required for accessing govt data sources.

To enable the e-KYC for your customers through us (WhatsLoan), you (a FinTech company/Bank/Lender) can get the access to our LASS validation tool in

a) Subscribe to our Digital Loan Key platform (Buy minimum digital loan keys with one-year validity)

b) Use our validation APIs with customized UI/UX on your platform (web/mobile) (requires a minimum number of requests per month)

By the way, do you know that we have built a Digital Loan Key, a unique financial identifier, that can retrieve your legacy documents (such as your Aadhaar card, pan card, bureau score, 10th mark sheets, birth certificate) online and enables you to get it verified within minutes and share with the lenders in one click.

The mission of this Digital Loan Series is to educate you and make you ready for the loan anytime!

If you happen to read this article, we assume you are somewhere in between of thinking for borrowing/purchasing a house. We recommend you to follow the series, or if you have any immediate query, reach out to us at social@whatsloan.com.

We also recommend you to share this with your people, your network, and younger ones so that they can be loan ready for the right time!